These experiences enriched her understanding of small business management and marketing strategies. Today, she channels toxic asset wikipedia this first-hand knowledge into her articles for Forbes Advisor. The Forbes Advisor Small Business team is committed to bringing you unbiased rankings and information with full editorial independence. We use product data, strategic methodologies and expert insights to inform all of our content and guide you in making the best decisions for your business journey.

This service connects users with experts who can provide setup and bookkeeping help. We picked QuickBooks Online because of its wide use among small business accounting professionals and its numerous online training resources and forums to get support when you need it. Plus all accounting tools and features can be conveniently accessed through one main dashboard, making bookkeeping more fluid and efficient.

This streamlined process allowed me to address all requirements directly from the invoice screen, providing clear guidance on what was needed to fully complete the task. Tabs along the top of the accounting page also gave me access to my banking activity. I was prompted to connect my bank account, and at that point, instructions said the system would automatically import my bank transactions into the OneUp accounting solution. I could star my favorite reports to add to my “favorite reports” list at the top of the page. When I clicked on a report, it was already populated with all my relevant data points. I only had to click the “send” button at the top of the page and specify an email recipient to share the report.

QuickBooks Online has some of the best reporting and bookkeeping features money can buy. Xero, Sage Business Accounting, and Zoho Books have stellar reports at a lower starting price than QuickBooks. And if you want straightforward finance tracking without in-depth analytics, Wave Accounting can help you with the basics. If you send invoices on the go, want to up your chances of getting paid on time by sending recurring invoices to repeat clients, and bill customers all over the world with multilingual invoicing, Zoho has you covered. And while Zoho Books does a great job of tackling all things invoice, you’ll get an arm’s length transaction even better deal by adding Zoho Invoice to your Zoho Books plan. Zoho Invoice is completely free for life, so whether you end up trying Zoho Books or not, we definitely recommend giving Zoho Invoice a look.

Can I use cloud accounting software on both Macs and PCs?

I clicked “edit dashboard” and was given the means to deselect reports I didn’t want to appear on the dashboard. Unfortunately, I was not able to add reports that I wanted to see there. Overall, the dashboard seemed very basic compared to some competitors. Still, it was uncluttered and easy to interpret and navigate. “Wave invoicing makes your life a whole lot easier and takes that worry off you. I’ve tried Quickbooks—it’s a bit more complicated and technical, and takes more time to set up.” An ERP is a complex software package that combines all of a firm’s systems, including accounting.

Essential Features of Accounting Software for Small Business

Overall, they have mixed feelings about its affordability for small businesses and the quality of its customer service. Many complain that the software needs more bank feed integration options and customization options. QuickBooks Online topped our list for its scalability, training resources, and mobile app. However, micro-businesses may find their needs more affordably met by Xero, and self-employed individuals will appreciate the ability to categorize personal and business expenses with QuickBooks Solopreneur.

- The software can also automatically determine the right taxes and offer businesses the flexibility to manually adjust.

- It was founded in 1983 and is headquartered in Mountain View, California.

- The simple, straightforward platform allows users to easily create invoices, manage expenses, generate reports, accept credit card payments through Square and more.

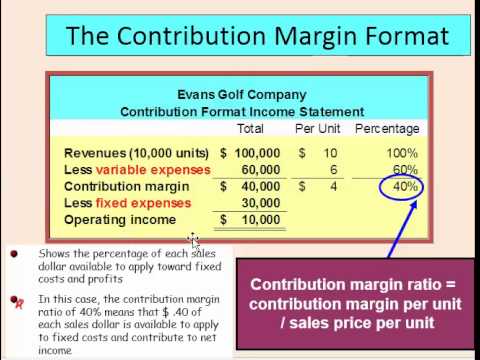

- Generally speaking, bookkeeping means tracking finances to create solid records while accounting means analyzing those records to draw conclusions about your business’s financial health.

- For instance, most virtual and outsourced bookkeeping services still use QuickBooks or proprietary in-house software—though some, like Bookkeeper360, also sync with Xero.

Best Accounting Software for Small Businesses for October 2024

When I clicked “+ create,” then “invoice,” I was taken to a long form to fill out to create an invoice. It was highly customizable, allowing me to answer details about the invoice that would aid in filing it in my storage system and making it searchable. For example, I began by entering basic invoicing information, such as the vendor’s name, the invoice number, the date and the amount and due dates. Businesses seeking a highly adaptable accounting solution that offers a precise and detailed overview of their finances should consider ZarMoney.

We focused on five distinct categories using 25 separate metrics to arrive at our ratings for the best providers. Here’s a look at each of these evaluation criteria in more detail. If you operate a chain restaurant, for example, choose an accounting software that you can integrate with your in-store point-of-sale (POS) system. Or, if you have a contract construction business or are a wholesaler, look for software that includes inventory management or mileage tracking and invoicing tools, respectively.

Is accounting software secure?

However, once I became difference between debtors and creditors more familiar with the software’s layout, completing tasks required no learning curve, even when setting up advanced actions such as automations. For example, to add a new project, I clicked “time tracking” on the left-hand menu, then the “projects” submenu item. From there, I could click “+New Project” at the top of the resulting screen and fill out a simple form to add my new project.